Double declining method formula

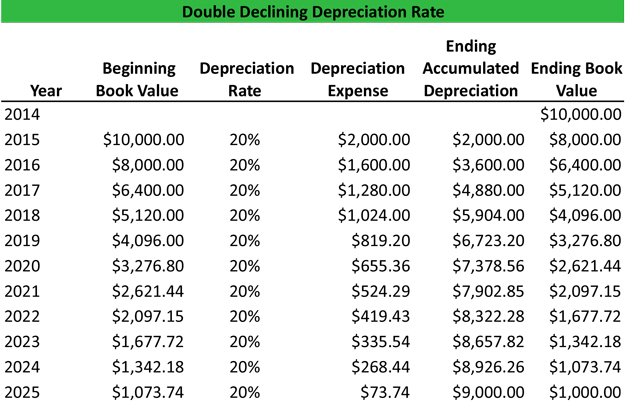

The quotient you get is the SLD rate. Prepare a depreciation schedule using double declining balance method.

How To Use The Excel Ddb Function Exceljet

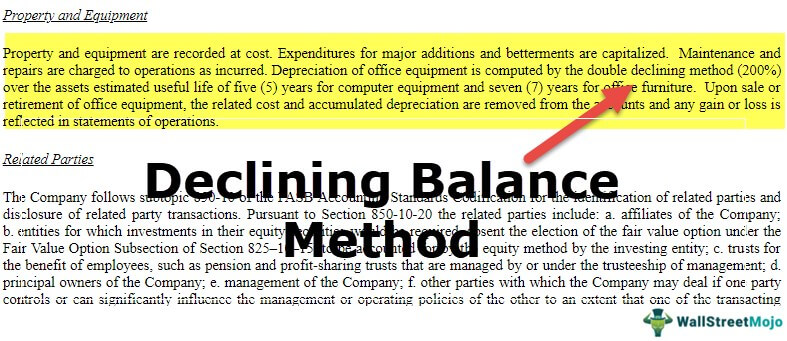

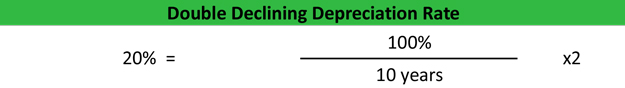

The term double in the double-declining balance depreciation comes from the determining of deprecation rate to be twice of the straight-line rate.

. To consistently calculate the DDB depreciation balance you need to only follow a few steps. Step 1 Straight-line depreciation rate. Double-declining Depreciation Rate Straight-line Depreciation Rate x 2.

50 000 x 40. Formula for Double Declining Balance Method The formula for depreciation under the double-declining method is as follows. The DDB depreciation method is a little more complicated than the straight-line method.

The double declining balance formula. The double-declining balance method depreciates the freezer by 600 2 x 01 x 3000 during the first year so that its book value is 2400 3000 600 at the start of the next accounting. Result DDBA2A3A43651 First days depreciation using double-declining balance method.

Depreciation 2 Straight-line depreciation percent. Double declining balance rate 2 x 20 40 The book value of the vehicle at the beginning of 2010 is 50 00000 The depreciation for the first year in 2010 is therefore. 15 02 or 20.

In other words the depreciation rate in the. Default factor is 2. Use the following formula to calculate double-declining depreciation rate.

Companies use this formula. 2 x basic depreciation rate x book value. Divide 100 by the number of years in your assets useful life.

The formula for double-declining balance is a relatively simple one. Step 2 Declining balance. When using the double-declining balance method be sure to use the following formula to make your calculations.

Because youre subtracting a different amount every year you cant simply. Here are the steps for the double declining balance method. Double declining balance is calculated using this formula.

The Double Declining Balance Depreciation Method Formula. Heres the formula for calculating the amount to be depreciated each year. 132 DDBA2A3A41212 First months.

Double Declining Balance Method formula 2.

Depreciation Formula Examples With Excel Template

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Method Of Depreciation Accounting Corner

Simple Tutorial Double Declining Balance Method Youtube

Double Declining Balance Depreciation Method Youtube

Double Declining Balance Depreciation Calculator

Double Declining Balance Depreciation Daily Business

What Is The Double Declining Balance Method Definition Meaning Example

Double Declining Balance Method Of Deprecitiation Formula Examples

Excelsoft Technology Quick Guide To Depreciation Part 2

What Is The Double Declining Balance Method Definition Meaning Example

Double Declining Balance Method Of Depreciation Accounting Corner

/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Double Declining Balance Ddb Depreciation Method Definition With Formula

Depreciation Expense Double Entry Bookkeeping

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Depreciation Formula Calculate Depreciation Expense

Double Declining Depreciation Efinancemanagement